pingguo123.site

Learn

Ways To Boost Up Your Credit Score

Experian Boost is an easy way for you to take control of your credit and build long-term credit health—just by paying your bills. Set up autopay. Opt for autopay for recurring bills, such as credit card and car payments. Your bill will come directly from your bank account on the day it's. How do you improve your credit score? · Review your credit reports. · Pay on time. · Keep your credit utilization rate low. · Limit applying for new accounts. Trying to raise your credit score? · Keep track of your progress. · Always pay bills on time. · Keep credit balances low. · Pay your credit cards more than once a. It then shows up on your credit report and damages your credit score. Be Applying for new credit can hurt your credit in a few ways. First, it. How To Increase Your Credit Score · 1. Read Your Credit Report · 2. Pay Your Bills on Time · 3. Set Up Payment Plans With Creditors · 4. Limit Applying for New. How to Improve Your Credit Score Fast · 1. Review Your Credit Reports · 2. Get a Handle on Bill Payments · 3. Aim for 30% Credit Utilization or Less · 4. Limit. Here are 10 ways to increase your credit score by points - most often this can be done within 45 days. The way to get a better credit score is to 1) consistently not have a ton of debt, 2) pay down the debt you have at regular and consistent intervals, and 3). Experian Boost is an easy way for you to take control of your credit and build long-term credit health—just by paying your bills. Set up autopay. Opt for autopay for recurring bills, such as credit card and car payments. Your bill will come directly from your bank account on the day it's. How do you improve your credit score? · Review your credit reports. · Pay on time. · Keep your credit utilization rate low. · Limit applying for new accounts. Trying to raise your credit score? · Keep track of your progress. · Always pay bills on time. · Keep credit balances low. · Pay your credit cards more than once a. It then shows up on your credit report and damages your credit score. Be Applying for new credit can hurt your credit in a few ways. First, it. How To Increase Your Credit Score · 1. Read Your Credit Report · 2. Pay Your Bills on Time · 3. Set Up Payment Plans With Creditors · 4. Limit Applying for New. How to Improve Your Credit Score Fast · 1. Review Your Credit Reports · 2. Get a Handle on Bill Payments · 3. Aim for 30% Credit Utilization or Less · 4. Limit. Here are 10 ways to increase your credit score by points - most often this can be done within 45 days. The way to get a better credit score is to 1) consistently not have a ton of debt, 2) pay down the debt you have at regular and consistent intervals, and 3).

Set up automatic bill payment If you have the money but keep forgetting to pay on time, put your bills on autopilot. Most companies are happy to help you set. A sure-fire way of paying bills on time is by setting recurring payments on "auto pay" in your online banking account. 35% Payment History. This is the single biggest factor: how reliably you pay your bills. · 30% Amounts Owed / Credit Utilization · 15% Length of Credit History. Ways to boost your credit score · 1. Make on-time payments · 2. Leave current accounts alone · 3. Keep your balances low · 4. Pay down your balances · 5. Limit new. 5 ways to improve your credit score · Pay your bills on time · Keep your balances low · Don't close old accounts · Have a mix of loans · Think before taking on. If you want to increase your credit history length, which makes up 15% of your credit score, the best way to do this is by being added as an authorized user by. Focusing on good financial practices like paying off your credit card balances in full each month will go a long way towards increasing your credit score. 1. Never miss a bill due date. Paying your bills on time is the cardinal rule of maintaining a good credit score. A good credit score can mean you qualify for cheaper rates on things like loans, credit cards, mobiles and mortgages. See how to improve yours. Pay your bills on time · Reduce your credit utilization ratio · Use your cards · Work to pay down outstanding debt · Look for errors on your bill and credit history. You can increase your credit limit one of two ways: Either ask for an increase on your current credit card or open a new card. The higher your overall available. Lowering your credit utilization ratio will often boost your credit scores, especially if your starting point is above the ideal 30% mark. Need to boost your credit score? These 4 programs can help (for free) · 1. Experian Boost · 2. TurboTenant Rent Reporting · 3. UltraFICO · 4. Grow Credit. Many credit-scoring models consider the number and type of credit accounts you have. A mix of installment loans and credit cards may improve your score. However. There are a few things you can do to quickly improve your credit score: Pay your bills on time: Late payments can have a negative impact on your credit score. 1. Review credit regularly. First things first, you'll likely want to monitor your credit regularly. That way, you can have an idea of where your credit stands. Nothing will raise your credit score faster or more effectively than paying bills on time and using your credit cards judiciously. Applying for credit · Compare your credit options · Compare your credit options · Use eligibility checkers before applying · Use eligibility checkers before. How to raise your credit score quickly · Lower your credit utilization rate · Ask for late payment forgiveness · Dispute inaccurate information on your credit. 1. Lower Your Credit Utilization Ratio. Each line of credit you have has a maximum amount. The percentage of that that you've charged is your credit.

How To Offer A Settlement To A Debt Collector

A good starting point for negotiation could be offering around 30% of the amount that you owe. You must convince the creditor that you can't pay the full amount. PROS · You'll likely pay less and get out of debt faster. · If you've missed payments with your creditor, and are in collections, settling will eventually help. DO NOT enter into a repayment plan, but instead offer a lump sum settlement as final payment. Some collections agencies will try to tack on interest or late. Debt collection settlement: advantages and disadvantages. Debt collection settlement, or debt settlement, is a strategy for eliminating debt by offering to. Create a settlement plan. Before talking to the debt collector, you should create a plan. · Decide how to negotiate. You will either negotiate by telephone or in. Before a debt collector can file a court case, they must send the debtor a written "validation notice" telling the debtor how much they owe, the name of the. What if I do not owe the debt? To dispute a debt, you must write a letter to the debt-collection agency within 30 days of their initial contact with you. If you. Decide how much you can afford to pay, and offer less. That way, you'll have some room to bargain. · The creditor should reduce the overall amount of the debt. Offer a Lump-Sum Settlement If you offer a lump sum to pay off the debt for less than you owe, understand that no general rule applies to all collection. A good starting point for negotiation could be offering around 30% of the amount that you owe. You must convince the creditor that you can't pay the full amount. PROS · You'll likely pay less and get out of debt faster. · If you've missed payments with your creditor, and are in collections, settling will eventually help. DO NOT enter into a repayment plan, but instead offer a lump sum settlement as final payment. Some collections agencies will try to tack on interest or late. Debt collection settlement: advantages and disadvantages. Debt collection settlement, or debt settlement, is a strategy for eliminating debt by offering to. Create a settlement plan. Before talking to the debt collector, you should create a plan. · Decide how to negotiate. You will either negotiate by telephone or in. Before a debt collector can file a court case, they must send the debtor a written "validation notice" telling the debtor how much they owe, the name of the. What if I do not owe the debt? To dispute a debt, you must write a letter to the debt-collection agency within 30 days of their initial contact with you. If you. Decide how much you can afford to pay, and offer less. That way, you'll have some room to bargain. · The creditor should reduce the overall amount of the debt. Offer a Lump-Sum Settlement If you offer a lump sum to pay off the debt for less than you owe, understand that no general rule applies to all collection.

Received a settlement letter from a debt collector · Call them and ask how much they will accept. Ask if they can do better. Record every call. with debt collection companies that offer you a credit card if you repay, in settlement agreement or payment plan, the debt collection agency must. If you pay off your debt or negotiate an agreement with the debt collector to pay a lesser amount before going to trial, you can settle your case and have it. Candidly, if they are offering to clear the debt for 1/3 of the original amount, you have nothing to lose by asking them to accept pingguo123.site you do agree to pay. Consider starting debt settlement negotiations by offering to pay a lump sum of 25% or 30% of your outstanding balance in exchange for debt forgiveness. However. 1. Understand the Debt · 2. Establish Your Negotiation Terms · 3. Speak to the Debt Collection Agency · 4. Get the Deal in Writing · 5. Make Your Payments as. If you or a loved one is trying to settle a judgment obtained by a creditor, you should speak with a consumer protection lawyer. They know how to help you. If you've fallen behind on a debt, your creditor could sell what you owe to a collection agency. Here's what to know when your debt goes into collections. Read. Whether you're negotiating directly with a creditor, or dealing with a collection agency, get any agreement in writing. You've gone to the great effort of. Debt settlement differs from credit counseling or DMPs. With debt settlement, no regular periodic payments are made to your creditors. Rather, the debt. Your lump sum is 75% of your total debt; You should offer each creditor 75% of what you owe them. Can I remove settled debts from my credit report? Debt settlement involves offering a lump-sum payment to a creditor in exchange for a portion of your debt being forgiven. · You can attempt to settle debts on. If you're facing challenges with credit card debt – particularly debts that have gone to collections – then you may have received some offers from companies. debt, 23 NYCRR 1 would not apply to the settlement. Does 23 NYCRR 1 apply to debt collector must provide and/or offer substantiation of the debt again. Within five days after a debt collector contacts you for the first time, they must send a written notice detailing the amount you owe, who you owe it to and how. Full and final settlement means that you ask your creditors to let you pay a lump sum instead of the full balance you owe on the debt. In return for having a. Contact the creditor, debt collector, or debt buyer that currently owns the debt, and make an offer to repay the debt in one lump sum in exchange for a complete. Five Steps to Debt Negotiation · Step 1: Stopping Creditor Phone Calls · Step 2: Validating the Debt · Step 3: Negotiating the Debt · Step 4: Settling the Debt. Most agencies would negotiate on different terms. Some might offer high percentage while some might offer a lower percentage. That would depend. ▻ How do I fill out the Settlement Agreement & Order Dismissing Case? · Payment Amount. State the total amount the parties agree will be paid. · Interest. Mark.

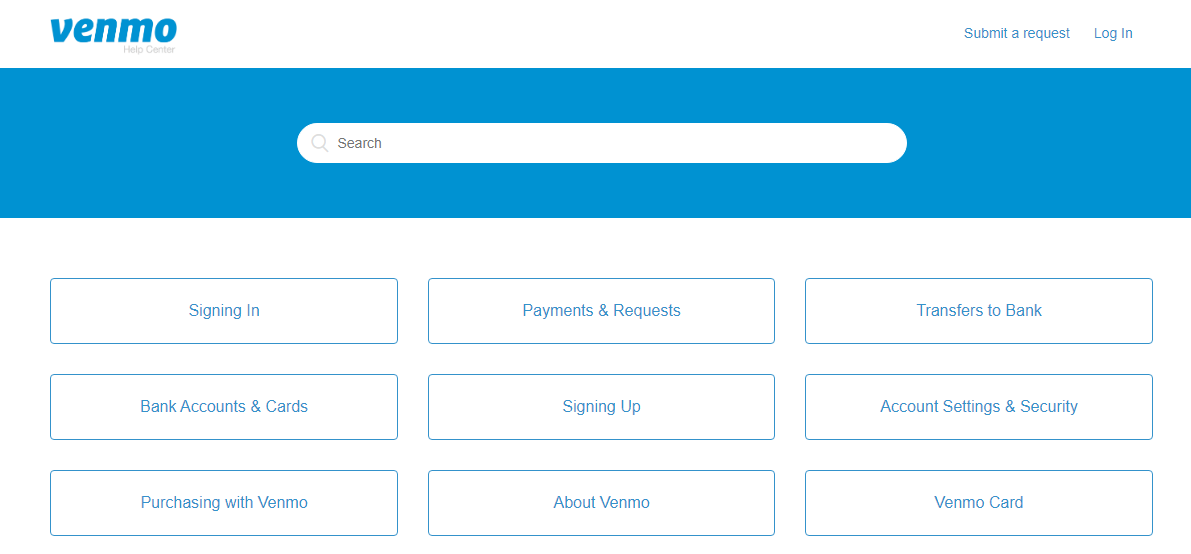

Help.Venmo.Com

Venmo is more than just a way to pay. It lets you split bills, keep track of expenses, send gifts, and more. You can even express yourself with custom payment. Venmo. Log in. Enter email, mobile, or username. Next. Sign up. Venmo. Log in. Enter email, mobile, or username. Next. Sign up. You will need to follow the steps on this page to fix your account pingguo123.site://pingguo123.site you require additional assistance. Reach out to Venmo support for help. Venmo should know if your account pingguo123.site” page. Anything else (such as a Gmail or Yahoo! email address. pingguo123.site today Service providers under contract who help with parts of our business operations (for example, fraud prevention. Official support handle for @Venmo. Need help? Tweet us M–F, 8am–10pm; Sat–Sun, 8am–5pm CT; or send us an email → pingguo123.site Venmo. Log in. Enter email, mobile, or username. Next. Sign up. Contact Venmo by calling , by mail to Venmo, Barrow Street, New York, NY , or visit pingguo123.site For general information. Venmo is more than just a way to pay. It lets you split bills, keep track of expenses, send gifts, and more. You can even express yourself with custom payment. Venmo. Log in. Enter email, mobile, or username. Next. Sign up. Venmo. Log in. Enter email, mobile, or username. Next. Sign up. You will need to follow the steps on this page to fix your account pingguo123.site://pingguo123.site you require additional assistance. Reach out to Venmo support for help. Venmo should know if your account pingguo123.site” page. Anything else (such as a Gmail or Yahoo! email address. pingguo123.site today Service providers under contract who help with parts of our business operations (for example, fraud prevention. Official support handle for @Venmo. Need help? Tweet us M–F, 8am–10pm; Sat–Sun, 8am–5pm CT; or send us an email → pingguo123.site Venmo. Log in. Enter email, mobile, or username. Next. Sign up. Contact Venmo by calling , by mail to Venmo, Barrow Street, New York, NY , or visit pingguo123.site For general information.

helps make electronic payments fast and easy. For more information, visit Venmo's link here: pingguo123.site Venmo phone app should be configured with a PIN or Touch ID pingguo123.site; JHM does not have control over payees. Tech Support Specialist: Renz O. Can you try to recover your Venmo account, reset the password ***** this link here: pingguo123.site For support, visit the Venmo Help Center pingguo123.site pingguo123.site + 1. Bach QR Codes's profile picture. Bach QR Codes. FLM's profile. Venmo is the fast, safe, social way to pay and get paid. Join over 83 million people who use the Venmo app today. SEND AND RECEIVE MONEY. Join the people who've already reviewed Venmo. Your experience can help others make better choices. How to enable Two-Factor Authentication for Venmo · Service Name. Venmo · Website. pingguo123.site · How to set up 2FA for Venmo? pingguo123.site Venmo. venmo. The cha-ching app Send & receive money. Earn rewards. Explore crypto. Grow your biz. For support, visit the Venmo Help Center pingguo123.site Customer support representatives are available to help you with any problems or questions++1-() you might have regarding your Venmo account. In-App. Venmo. venmo. The cha-ching app Send & receive money. Earn rewards. Explore crypto. Grow your biz. For support, visit the Venmo Help Center pingguo123.site Venmo. likes · talking about this. Pay, split, & share with Venmo. Need Help? Visit pingguo123.site The cha-ching app Send & receive money. Earn rewards. Explore crypto. For support, visit the Venmo Help Center pingguo123.site If you receive a fake text, email a screenshot of the text to [email protected] Then delete the email or text from your account. Try to get your money back. Venmo Winter Updates: New Help Center, Faster Withdrawals Say Hello to pingguo123.site You have questions, we have answers. We just built a brand new Help Center. You will need to follow the steps on this page to fix your account pingguo123.site://pingguo123.site you require additional assistance. Venmo Winter Updates: New Help Center, Faster Withdrawals Say Hello to pingguo123.site You have questions, we have answers. We just built a brand new Help. Venmo Winter Updates: New Help Center, Faster Withdrawals Say Hello to pingguo123.site You have questions, we have answers. We just built a brand new Help Center. pingguo123.site · pingguo123.site Help and support. Help centre · Mid-market rate · Pricing. Learn more. Send money. Link your PNC accounts to Venmo · Obtain your account number and routing number from a check or via Online Banking. · Visit (External) pingguo123.site and click. Keep Records: Maintain records of all communications with Venmo support,✓➤ +1-()⚡ \#\ including dates and times of emails and phone calls. Stay.

What Is An Llc Vs Corporation

Unsure of whether to form a Limited Liability Company (LLC) or a corporation? Learn the differences and advantages of each at pingguo123.site An incorporated business is a corporation, while an LLC is a limited liability company. Corporations and LLC share similar benefits, but there are critical. Operational flexibility: LLCs have fewer regulatory requirements and greater operational flexibility than corporations. They have fewer formal meeting. Limited liability companies and corporations are types of legal business structures—ways to legally organize a business under state law. LLCs compare to corporations when it comes to taxation, liability protection, management structure, ownership, and compliance requirements. LLCs are structured like a partnership (or a sole proprietorship in the case of a single member or married couple LLC) but with the same limited liability. LLCs are considered pass-through entities for the purpose of US taxation; they don't file taxes in their own right, but have their income reported on the. The two common choices are either a Limited Liability Company, or LLC, or a corporation. A corporation is a good choice for a company that is going to get. A Limited Liability Company (LLC) is an entity created by state statute. Depending on elections made by the LLC and the number of members, the IRS will. Unsure of whether to form a Limited Liability Company (LLC) or a corporation? Learn the differences and advantages of each at pingguo123.site An incorporated business is a corporation, while an LLC is a limited liability company. Corporations and LLC share similar benefits, but there are critical. Operational flexibility: LLCs have fewer regulatory requirements and greater operational flexibility than corporations. They have fewer formal meeting. Limited liability companies and corporations are types of legal business structures—ways to legally organize a business under state law. LLCs compare to corporations when it comes to taxation, liability protection, management structure, ownership, and compliance requirements. LLCs are structured like a partnership (or a sole proprietorship in the case of a single member or married couple LLC) but with the same limited liability. LLCs are considered pass-through entities for the purpose of US taxation; they don't file taxes in their own right, but have their income reported on the. The two common choices are either a Limited Liability Company, or LLC, or a corporation. A corporation is a good choice for a company that is going to get. A Limited Liability Company (LLC) is an entity created by state statute. Depending on elections made by the LLC and the number of members, the IRS will.

The main difference between an LLC and a corporation is that an LLC is governed by a contract between the members. A corporation, on the other hand, is governed. By contrast, a regular corporation (CCorporation) is subject to being taxed twice on its profit; at the corporate level and when the profits are distributed to. The main difference between an LLC and a corporation is that an llc is owned by one or more individuals, and a corporation is owned by its. A corporation is owned by shareholders and a limited liability company is owned by members. Both the corporate shareholder and the LLC member can be protected. The biggest difference is that corporations have “shareholders” and LLCs have “members.” Corporations tend to have many owners, while LLCs are now the most. The biggest difference is that corporations have “shareholders” and LLCs have “members.” Corporations tend to have many owners, while LLCs are now the most. A Limited Liability Company (LLC) is a business structure allowed by state statute. Each state may use different regulations, you should check with your state. An LLC passes taxes to owners and protects their personal assets; an S corporation is a tax-filing status that allows a company to pass taxes to. There are four types of legal entities a business can classify itself as. A limited liability company (LLC), C Corporation, S Corporation, or what is called. Profits and Losses: An LLC is a pass-through entity meaning that the profits and losses pass through the company to the owners. In a corporation, income taxes. There are many differences between corporations and LLCs that have nothing to do with taxation. This article will highlight ten of them. However, an LLC is owned by one or more individuals, while a corporation is owned by its shareholders. Additionally, they vary in terms of tax treatment and. A corporation can only pass profit to its shareholders. An LLC can pass operating losses as well. LLC members can thus receive losses that are deductible from. The LLC is generally the most popular entity to use in Arizona due to its flexibility (taxes, governance and distributions), increased asset protection and. An LLC and a corporation have quite a bit in common, especially in comparison to more informal business types, such as sole proprietorships and general. Corporations and LLCs differ in significant ways, such as the management structures, the statutory filing requirements, whether you must hold annual meetings. A limited liability company (LLC) and a corporation are known as business structures. By filing as a business, you create a legal entity that's separate from. Starting your LLC vs. S corp journey Many entrepreneurs set up their new ventures as LLCs to have some legal protection for their personal assets. However. The main difference between an LLC and a corporation is that an LLC is governed by a contract between the members. A corporation, on the other hand, is governed. Explore the differences between an LLC and Corporations to determine the ideal structure for your business, with insights from our comprehensive guide.

Non Profit Life Insurance

Nonprofit insurance is a type of business insurance that helps protect (c)(3) organizations from risks and claims that can come up during normal operations. benefits. In partnership with Northeast Delta Dental, members save 10% on Dental Insurance. ◻ Health, Dental, Vision. ◻ Long Term Care. ◻ Life Insurance. Nonprofits Insurance Alliance (NIA) provides insurance for nonprofits, with fair & equitable pricing. Like you, NIA is a (c)(3) nonprofit! In these situations, professional liability insurance covers board members, non-profit directors, volunteers, employees, and the institution itself. Another. Protect your non-profit & the team that makes it possible with Non-Profit Insurance. Serving clients in Greenville, SC, and across the US. Nonprofits must be prepared for various scenarios, from accidents and injuries to legal liabilities and cyber threats. That is where nonprofit insurance. Some charities are looking into taking out life-insurance policies on their donors and supporters in an attempt to generate income for the future. Your nonprofit needs insurance. You can buy it from a nonprofit. Nonprofits Insurance Alliance (NIA) is a (c)(3) nonprofit, just like you. You can donate both permanent life insurance (including whole life and universal life) and term life insurance to charity, but the donation options differ. Nonprofit insurance is a type of business insurance that helps protect (c)(3) organizations from risks and claims that can come up during normal operations. benefits. In partnership with Northeast Delta Dental, members save 10% on Dental Insurance. ◻ Health, Dental, Vision. ◻ Long Term Care. ◻ Life Insurance. Nonprofits Insurance Alliance (NIA) provides insurance for nonprofits, with fair & equitable pricing. Like you, NIA is a (c)(3) nonprofit! In these situations, professional liability insurance covers board members, non-profit directors, volunteers, employees, and the institution itself. Another. Protect your non-profit & the team that makes it possible with Non-Profit Insurance. Serving clients in Greenville, SC, and across the US. Nonprofits must be prepared for various scenarios, from accidents and injuries to legal liabilities and cyber threats. That is where nonprofit insurance. Some charities are looking into taking out life-insurance policies on their donors and supporters in an attempt to generate income for the future. Your nonprofit needs insurance. You can buy it from a nonprofit. Nonprofits Insurance Alliance (NIA) is a (c)(3) nonprofit, just like you. You can donate both permanent life insurance (including whole life and universal life) and term life insurance to charity, but the donation options differ.

Eight Liability Coverages for Nonprofits · Commercial General Liability (CGL) · Directors' & Officers' Liability (D&O) · Employment Practices Liability (EPL or. Life Happens is a nonprofit organization founded in by industry leaders who recognized the need to provide more people with educational information about. Let us do the hard work for you. 15K+. Lives Insured. When you put your nonprofit in our care, it's not just the name, it's. Find out how coverage from AmTrust helps nonprofit organizations focus on doing what they do best: helping others. Partner with our nonprofit insurance. Nonprofit Insurance & Risk Management. Let us deliver the expertise, support and advocacy that are critical to your mission — today, and well into the future. You can find affordable, high-value insurance for your nonprofit Health insurance, dental and vision insurance, life and disability policies, flexible. Atlas Insurance Agency provides nonprofit insurance coverage options for charities and other nonprofit organizations in Hawaii and across the U.S. There are mutual companies - insurance companies who are owned, in essence, by the policy holders and are not publicly traded. The New York Life Foundation invests in programs that benefit young people, particularly in educational enhancement and childhood bereavement support. Insurance for Maryland Non Profit Organizations. Call for Great Coverage at Great Rates. We are located in Pasadena, MD. We chose Nonprofits Insurance Alliance (NIA) as the best overall nonprofit insurance provider because of their specialized nonprofit policies. Nonprofit insurance from AmTrust protects your organization, property and people to let you focus on your mission. Unlock the full potential of your nonprofit organization with NFP's specialized nonprofit insurance solutions and benefits. Nonprofit Insurance Coverage – Protection for Organizations. Our Nonprofits are dedicated to their mission. We are equally driven to ensure our Nonprofit. management liability insurance specific to nonprofit organizations Life Insurance Company provides life insurance and fixed annuities. Each. for life insurance, disability income insurance, major medical and accidental death health-care providers on a nonprofit, self-supporting basis, so long as. PHLY has the coverage the non-profit, social services, and human services sector needs, including commercial general liability and professional liability. As a general principle, the gift of a life insurance policy to any recipient, whether such recipient is a charity or other third party, involves the same. Insurance for Nonprofits and Social Service Organizations is unique. Bitner Henry Insurance group has over eighty years experience providing coverage for. The Gallagher Nonprofit insurance and consulting team provides risk management and benefits advisory services and programs that empower your mission.

Small Business Merchant Services

Compared to other processors, Merchant One's subscription pricing can be more affordable, especially for businesses with predictable transaction volumes. As part of the First Data and Fiserv family, Clover delivers a robust business management platform coupled with an extensive offering of merchant services to. Find the right payments tools for your business to streamline card and check processing with speed and ease. Explore merchant services from U.S. Bank. Accept major credit/debit cards and get business management tools with Citi Merchant Services. Customers can easily pay you in-person or online. Learn more. Axos Bank offers a range of merchant services, including credit card processing and e-commerce solutions, to help your business grow. Best Merchant Services of ; Best Overall: Helcim ; Best for Ease of Use: Square ; Best for Nonprofit Organizations: iATS Payments ; Best for E-commerce Stores. When it comes to running a business, no one size fits all. That's why TD offers a variety in-person, mobile and eCommerce point-of-sale (POS) solutions – so. With a Midland States Bank merchant account, your business can open its doors to new customers by processing a broader range of payment types. 10 Best Merchant Services of August · Best Merchant Services · Square POS · Helcim · Stripe · National Processing · Chase Payment Solutions℠ · Payment Depot. Compared to other processors, Merchant One's subscription pricing can be more affordable, especially for businesses with predictable transaction volumes. As part of the First Data and Fiserv family, Clover delivers a robust business management platform coupled with an extensive offering of merchant services to. Find the right payments tools for your business to streamline card and check processing with speed and ease. Explore merchant services from U.S. Bank. Accept major credit/debit cards and get business management tools with Citi Merchant Services. Customers can easily pay you in-person or online. Learn more. Axos Bank offers a range of merchant services, including credit card processing and e-commerce solutions, to help your business grow. Best Merchant Services of ; Best Overall: Helcim ; Best for Ease of Use: Square ; Best for Nonprofit Organizations: iATS Payments ; Best for E-commerce Stores. When it comes to running a business, no one size fits all. That's why TD offers a variety in-person, mobile and eCommerce point-of-sale (POS) solutions – so. With a Midland States Bank merchant account, your business can open its doors to new customers by processing a broader range of payment types. 10 Best Merchant Services of August · Best Merchant Services · Square POS · Helcim · Stripe · National Processing · Chase Payment Solutions℠ · Payment Depot.

What do you need to open a merchant account for your small business? · A merchant account application. This application will ask for basics like your tax ID. You can accept credit cards through payment services providers like PayPal, CashApp's Cash for Business, or Venmo for Business. Those services may be more. If you're a small business owner, you know that choosing what payment options you will accept is a big decision. Merchant services are any services your. Whether you are working from home, the shop, or on the road, Moolah's small business merchant services are designed to meet your specific payment needs. Find out more about Paysafe's merchant services for small business. We offer super-competitive processing rates, PCI protection and next-day funding. Host Merchant Services is the leading small business merchant services provider. Clover point of sale, mobile payments, and online payment gateways. Stax by Fattmerchant offers payment processing for small businesses. It offers a monthly subscription and eliminates percentage-based transaction fees. So. Easy Pay Direct offers secure and reliable credit card processing solutions for small businesses. Our tailored merchant account services feature advanced fraud. They offer businesses merchant accounts that allow those businesses to accept credit and debit cards as payment. Most merchant account providers also provide. Why do you need a merchant account? It's important for your business to have a merchant account. Thinking of your business income stream, you want to provide. Our Merchant Services accounts provide businesses with credit card and payment processing solutions. Learn more and apply today at pingguo123.site Capital One Merchant Services powered by Worldpay gives you access to customer insights, emerging payments technology and tools to help your business mitigate. Merchant Services enable your business to accept credit cards, debit cards and other types of electronic payments. You can accept cards and electronic payments. 9 Best Merchant Services for Small Business Owners · 1. Payment Depot: Best overall with low subscription-based pricing · 2. Stax: Best for high-volume. Small Business Credit Card Processing Provider, Merchant accounts, and Best Merchant Services for Small Businesses. Process your merchant account credit. Learn about merchant services for small businesses at Citizens. Take debit and credit card payments in store, online or on the go with our payments. Merchant Services provides your business with the ability to accept credit cards and other forms of electronic payments. Many merchant service providers offer a. We need to look at the processing rates first. With every merchant service, you pay a small fee each time a transaction is processed. It's usually between 1 to. Truist Merchant Services helps small business owners accept payments online, in person or on the go. Simple, seamless and secure payment processing. Whether you're a small business or a larger enterprise, our top credit card processors can help you accept credit card payments and grow your business. The way.

Buying Rights

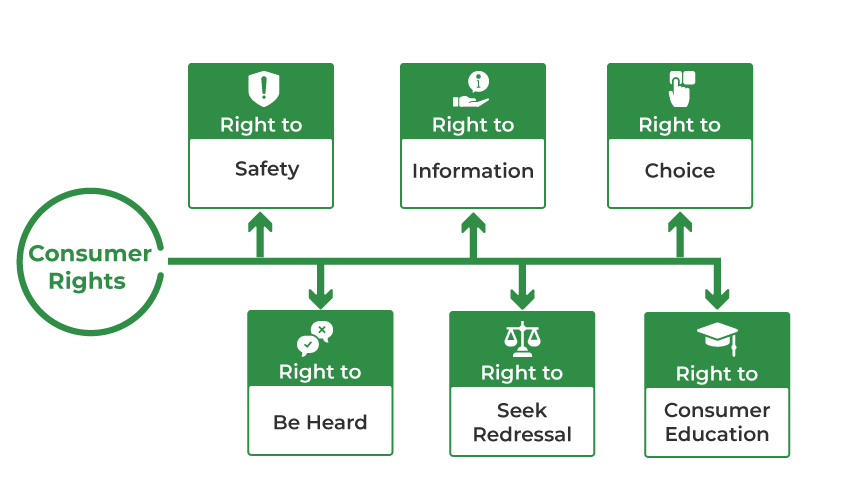

Buying products · Satisfactory quality: The product shouldn't be damaged or faulty when you receive it. · Fit for purpose: You should be able to use it for what. Buying a Used Car? Know Your Rights For example, any offer by a seller on Craigslist to provide buyer protection from eBay Motors are invalid. Key Takeaways. Purchase rights are offers to existing shareholders to buy additional shares in proportion to the number of shares already owned. If you buy joint property before marriage, it is best to have a written contract known as a cohabitation agreement that sets forth how you will deal with the. What rights do you have when buying goods online? · send a clear notice to the business that the consumer is withdrawing from the contract, preferably by. You are protected when it comes to buying, owning, and repairing your car. If you have been cheated, the Attorney General's Office may be able to help. If you find a home you want to buy, you must make a written offer to buy it. Verbal offers and agreements for land may not be valid. A realtor can provide a. It is possible to get permission to use a song online by buying the rights through a PRO, using a commercial music streaming service, or finding inexpensive. Includes information on the rights of consumers when making purchases or paying for services in Ontario, buying and selling, consumer law, consumer protection. Buying products · Satisfactory quality: The product shouldn't be damaged or faulty when you receive it. · Fit for purpose: You should be able to use it for what. Buying a Used Car? Know Your Rights For example, any offer by a seller on Craigslist to provide buyer protection from eBay Motors are invalid. Key Takeaways. Purchase rights are offers to existing shareholders to buy additional shares in proportion to the number of shares already owned. If you buy joint property before marriage, it is best to have a written contract known as a cohabitation agreement that sets forth how you will deal with the. What rights do you have when buying goods online? · send a clear notice to the business that the consumer is withdrawing from the contract, preferably by. You are protected when it comes to buying, owning, and repairing your car. If you have been cheated, the Attorney General's Office may be able to help. If you find a home you want to buy, you must make a written offer to buy it. Verbal offers and agreements for land may not be valid. A realtor can provide a. It is possible to get permission to use a song online by buying the rights through a PRO, using a commercial music streaming service, or finding inexpensive. Includes information on the rights of consumers when making purchases or paying for services in Ontario, buying and selling, consumer law, consumer protection.

This policy brief analyzes development right transfers in New York City between and , looking at the prices paid, number of rights transferred. Recently Dua Lipa, Taylor Swift and Rihanna have bought back the rights to their music, while Bruce Springsteen, Bob Dylan and Dr. Dre have sold theirs. What you can expect when buying goods in a store or online, and when you are buying digital services such as a video game or an app. GTranslate · 1. Figure out how much you can afford · 2. Know your rights · 3. Shop for a loan · 4. Learn about homebuying programs · 5. Shop for a home · 6. Make an. The Home Buyers' Bill of Rights will: Ban blind bidding, which prevents bidders from knowing the bids of other prospective buyers, and ultimately drives up. Your right to buy your council home - including how to apply, who is eligible, discounts available and where to get help and advice. Well owners or water users who need additional groundwater can buy or lease all or part of the groundwater withdrawal rights authorized in an existing permit. Buying a Used Car. Know Your Rights. Other Consumer Problems · Know Your Rights · Court Information · Find Legal Help. 1 Resource(s) Found. Filter By. Find out what rights you have when buying a used car from a dealer, private seller or auction. Learn more about what to do if your used car is faulty. Maine has enacted a number of laws that deal with consumer protection when it comes to purchasing a used motor vehicle. For example, a used car must always meet. Information on your rights as a customer when buying products. Consumer law when buying goods explained. Buying goods · Buying and returning goods. What are your rights when you buy goods? · Buying second-hand goods. When you buy a second-hand item from a business. To buy the rights, you should consider how much you can offer and then reach out to the appropriate person to begin negotiating details. 1 Examine the type of rights you can purchase, and decide which are best for your particular use. This policy brief analyzes development right transfers in New York City between and , looking at the prices paid, number of rights transferred. This guide breaks down the basic information that every mineral buyer needs and explores types of mineral rights, where to find minerals for sale, how to buy. Marylanders purchase more than 10, new homes each year. The purchase of a new home is protected by Maryland law. Understanding your rights and. Certified Transferable Development Rights can be bought and sold just like any other commodity. Once TDRs become certified, the owner can sell them to any. Paying Final Respects: Your Rights When Buying Funeral Goods and Services This brochure provides a brief overview of the Funeral Rule, which makes it possible. Consumer rights to a repair, replacement or refund, contract cancellation, claiming compensation for damages and loss, warranties. Unfair business practices.

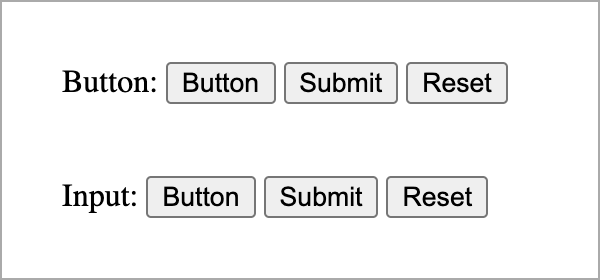

Html Button

The button element represents a button labeled by its contents. The element is a button. The type attribute controls the behavior of the button when it is. In HTML, buttons are clickable elements that take actions. They can submit a form, reset a form, or perform a JavaScript function. HTML #course #tutorial HTML CSS buttons tutorial example explained. src/app/pingguo123.site; src/app/pingguo123.site button>Defaultbutton> button shape="round">Roundbutton> button>. Definition and Usage. The button> tag defines a clickable button. Inside a button> element you can put text (and tags like. An HTML form is a section of a document containing normal content, markup, special elements called controls (checkboxes, radio buttons, menus, etc.), and labels. onclick Event ; Example. Call a function when a button is clicked: · button · ="myFunction()"> ; In HTML: · element · ="myScript" ; Click a button> to display the date. vs. Button Elements in HTML. You can also create buttons using the tag and setting the type attribute of the element to "button". Unlike the button. Learn how to add a link to a button in HTML using an anchor tag to wrap the button. 👩 💻 Technical question Asked over 1 year ago in HTML by Alex. The button element represents a button labeled by its contents. The element is a button. The type attribute controls the behavior of the button when it is. In HTML, buttons are clickable elements that take actions. They can submit a form, reset a form, or perform a JavaScript function. HTML #course #tutorial HTML CSS buttons tutorial example explained. src/app/pingguo123.site; src/app/pingguo123.site button>Defaultbutton> button shape="round">Roundbutton> button>. Definition and Usage. The button> tag defines a clickable button. Inside a button> element you can put text (and tags like. An HTML form is a section of a document containing normal content, markup, special elements called controls (checkboxes, radio buttons, menus, etc.), and labels. onclick Event ; Example. Call a function when a button is clicked: · button · ="myFunction()"> ; In HTML: · element · ="myScript" ; Click a button> to display the date. vs. Button Elements in HTML. You can also create buttons using the tag and setting the type attribute of the element to "button". Unlike the button. Learn how to add a link to a button in HTML using an anchor tag to wrap the button. 👩 💻 Technical question Asked over 1 year ago in HTML by Alex.

Forms: The HTML tag which lets you put pictures and other effects into a button. You can include an element inside your button> element to display the image on the button. You can still add text to the button, resulting in a. Flat buttons are usually used within elements that already have depth like cards or modals. Raised. button cloudbutton cloudbutton. button. The pingguo123.site website provides a simple, form-based approach to generate HTML markup for a Tweet button you may copy-and-paste into your. One of the first ways you can add a button to your page is to use the and button > tags. Here is how you might do so. A little bit easier and it looks exactly like the button in the form. Just use the input and wrap the anchor tag around it. An HTML form is a section of a document containing normal content, markup, special elements called controls (checkboxes, radio buttons, menus, etc.), and labels. vs. Button Elements in HTML. You can also create buttons using the tag and setting the type attribute of the element to "button". Unlike the button. html="true" title="Tooltip with HTML"> Tooltip with HTML button>. Usage. The tooltip plugin generates content and markup on demand. HTML - button> Tag. Previous · Next. HTML button> tag is used to create a button. Buttons are normally used on forms to submit the form, or it can be use. HTML Button onClick=" ">. The Html button onclick=" "> is an event attribute, which executes a script when the button is clicked. This attribute is supported. DOCTYPE html> html> Button as a Links Click the button to go to the HTML tutorial. . We need to create an HTML button, that acts like a link (ie, clicking on it the user is redirected to the specified URL). There are some methods, we are going. HTML Buttons is a free toolkit for adding buttons to your website. It's made with pure HTML and CSS. Use ready made buttons or use the button generator. Adaptive-width HTML Button For areas of your email that tend to be very wide, an adaptive-width button may be the best to use. This button's width is. The button element represents a button labeled by its contents. The element is a button. The type attribute controls the behavior of the button when it is. Well organized and easy to understand Web building tutorials with lots of examples of how to use HTML, CSS, JavaScript, SQL, Python, PHP, Bootstrap, Java. With JSX you pass a function as the event handler, rather than a string. For example, the HTML: button onclick=". This plugin displays HTML content and records responses generated by button click. The stimulus can be displayed until a response is given, or for a pre-. Button Types · submit — Submits the current form data. (This is default.) · reset — Resets data in the current form. · button — Just a button. Its effects must.

Freddie Mac 30 Year Mortgage Rate History

Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. Mortgage rate trends (APR). Jun 21 Jul 16 Aug 16 Sep 3 5% 6% 7% A Freddie Mac report concluded that a typical borrower can expect to save. The year fixed mortgage rate hit a record high of % in Mortgage Rates as of September 5, Yr FRM. mortgage. Recent News. Aug. 22, , PM UTC (AP)Average rate on a year mortgage eases to %, the lowest level in 15 months. Aug. 15, , PM. Weekly average mortgage rates since Data is provided by Freddie pingguo123.sitet and Historical Mortgage Rates. Yr FRM, Yr FRM, 5/1-Yr ARM. Date. Weekly average mortgage rates since Data is provided by Freddie pingguo123.sitet and Historical Mortgage Rates. Yr FRM, Yr FRM, 5/1-Yr ARM. Date. According to Freddie Mac's records, the average year rate jumped from % in January to a high of % at the end of October. Freddie Mac's Primary Mortgage Market Survey®. %. August 22, Year Fixed Rate Mortgage Updated Weekly. Freddie Mac surveys lender data. 30 Year Mortgage Rate in the United States averaged percent from until , reaching an all time high of percent in October of Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. Mortgage rate trends (APR). Jun 21 Jul 16 Aug 16 Sep 3 5% 6% 7% A Freddie Mac report concluded that a typical borrower can expect to save. The year fixed mortgage rate hit a record high of % in Mortgage Rates as of September 5, Yr FRM. mortgage. Recent News. Aug. 22, , PM UTC (AP)Average rate on a year mortgage eases to %, the lowest level in 15 months. Aug. 15, , PM. Weekly average mortgage rates since Data is provided by Freddie pingguo123.sitet and Historical Mortgage Rates. Yr FRM, Yr FRM, 5/1-Yr ARM. Date. Weekly average mortgage rates since Data is provided by Freddie pingguo123.sitet and Historical Mortgage Rates. Yr FRM, Yr FRM, 5/1-Yr ARM. Date. According to Freddie Mac's records, the average year rate jumped from % in January to a high of % at the end of October. Freddie Mac's Primary Mortgage Market Survey®. %. August 22, Year Fixed Rate Mortgage Updated Weekly. Freddie Mac surveys lender data. 30 Year Mortgage Rate in the United States averaged percent from until , reaching an all time high of percent in October of

year and year fixed-rate loans. In addition the survey provided FHFA is designating an adjusted version of Freddie Mac's yr FRM Primary Mortgage. The housing GSEs are the Federal National Mortgage Association. (Fannie Mae), the Federal Home Loan Mortgage Corporation (Freddie. Mac), and the Federal Home. Every year, new loan limits are announced for mortgage loans which may be purchased by the Federal National Mortgage Association (FNMA, or Fannie Mae). Freddie Mac has been running the Primary Mortgage Market Survey (PMMS) for over 50 years. For the past 10 years I have managed the team that ran. The Freddie Mac Primary Mortgage Market Survey surveys lenders weekly with results released each Thursday at 10 am EST. year and year fixed-rate mortgages. The survey reflects market trends and isn't specific to Freddie Mac mortgage rates. What role did Fannie and. 17, (GLOBE NEWSWIRE) -- Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey (PMMS), showing that the year fixed-. This data feed provides two types of time-series: mortgage rates and historical housing price indices. For example, FMAC/1NC is the Quandl Code for 1-Year. mortgage rate doesn't always tell the whole story. With that in mind, let's dive in. What is the historical average? Freddie Mac first started keeping. The chart below shows interest rates for year fixed-rate, year fixed-rate, and 5/1 ARM mortgages as reported by Freddie Mac to the Federal Reserve Bank. On November 17, , Freddie Mac changed the methodology of the Primary Mortgage Market Survey® (PMMS®). The weekly mortgage rate is. The average year fixed rate mortgage (FRM) held at % from Aug. 29 to Sept. 5, according to Freddie Mac. “Mortgage rates remained flat this week as. The Federal Home Loan Mortgage Corporation, more commonly known as Freddie Mac, began tracking average annual rates for mortgages starting in In the first. According to Bankrate, the interest rate for a standard year fixed mortgage is % as of April The Federal Home Loan Mortgage Corporation (FHLMC), commonly known as Freddie Mac, is a publicly traded, government-sponsored enterprise (GSE). Year Fixed Rate Mortgage Average in the United States from FRED Year Fixed Rate Mortgage Average in the United States. MORTGAGE30US Freddie Mac. The average interest rate is % for a year, fixed-rate mortgage in the United States, per mortgage technology and data company Optimal Blue. Introduction to Year Fixed Mortgages ; FHA, %, %, + ; Jumbo, %, %, “The average year fixed-rate mortgage hit a record percent on history,” said Sam Khater (left), Freddie Mac's Chief Economist. Fifteen.

Credit Card What Is A Balance Transfer

A balance transfer involves moving the debt from one or more credit card accounts to a different credit card. This way, you can focus on what you still owe. Transferring a credit card balance can help you to lower the cost of your credit card borrowing and consolidate multiple debts. A balance transfer credit card allows you to transfer debt from one credit card to another card. A balance transfer means moving all or part of the debt from one or more credit cards to another credit card. It's essentially transferring your credit card debt to another card with zero percent (or low) rates that allow you to whittle down the debt without paying. With a Wells Fargo balance transfer credit card, you can pay off higher interest rate balances, cover planned or unexpected expenses, and simplify your. A balance transfer moves a balance from a credit card or loan to another credit card. Transferring balances with a higher annual percentage rate (APR) to a card. Chase online lets you manage your Chase accounts, view statements, monitor activity, pay bills or transfer funds securely from one central place. A balance transfer is a method of debt consolidation where you combine existing credit card debt and other qualifying debts within one single credit card. This. A balance transfer involves moving the debt from one or more credit card accounts to a different credit card. This way, you can focus on what you still owe. Transferring a credit card balance can help you to lower the cost of your credit card borrowing and consolidate multiple debts. A balance transfer credit card allows you to transfer debt from one credit card to another card. A balance transfer means moving all or part of the debt from one or more credit cards to another credit card. It's essentially transferring your credit card debt to another card with zero percent (or low) rates that allow you to whittle down the debt without paying. With a Wells Fargo balance transfer credit card, you can pay off higher interest rate balances, cover planned or unexpected expenses, and simplify your. A balance transfer moves a balance from a credit card or loan to another credit card. Transferring balances with a higher annual percentage rate (APR) to a card. Chase online lets you manage your Chase accounts, view statements, monitor activity, pay bills or transfer funds securely from one central place. A balance transfer is a method of debt consolidation where you combine existing credit card debt and other qualifying debts within one single credit card. This.

A balance transfer is a convenient way to move outstanding balances from other higher-interest credit cards or loans to your HSBC Credit Card. You can transfer an existing credit card or loan balance to a BECU credit card. With many options to fit your needs, our credit cards offer competitive rates. Balance transfers allow you to take the amount owed on your high interest credit card and move it to one with a lower interest rate for an introductory period. A credit card balance transfer is a transaction where your new credit card issuer moves outstanding debt to a different credit card. Transfer a balance to your Wells Fargo Credit Card and help your money go further. Credit card balance transfers work by directly paying off the balances you have with other creditors using available credit. Rather than receiving a lump sum of. The takeaway. If you are someone who is serious about getting ahead of your payments, a balance transfer is a great option. By having a lower APR, you can allow. A balance transfer is when you move your existing credit card balance(s) to another credit card with a different provider. A balance transfer is a simple way to keep all of your outstanding balances, payments, and due dates together under one card. 5. Does SDFCU do balance transfers? If you already have one of our cards and you want to consolidate your other card balances to your SDFCU credit card, you. CK Editors' Tips††: Balance transfer credit cards allow you to move your existing credit card debt to a new card, where you can pay it off with a lower. Credit card balance transfers allow you to move debt from an existing credit card account to a new card at a lower interest rate. Specially designed balance. Intro balance transfer fee of $5 or 3% of the amount of the transfer, whichever is greater for transfers completed within 4 months of account opening. After. You can expect to pay a balance transfer fee of 3% to 5% of the amount you're transferring, but you don't have to pay this fee out of pocket. Instead, it's. You generally need good or excellent credit to qualify for a balance transfer credit card. According to FICO, this means having a credit score of or higher. A balance transfer involves moving outstanding debt from one credit card to another card—typically, a new one. A balance transfer allows you to take existing balances from one or more credit card accounts and transfer that debt to a new credit card with a lower interest. A credit card balance transfer works by allowing you to move balances from one card to another, ideally at a lower interest rate, helping you to pay your. It typically takes 3–14 days to complete a balance transfer to a Capital One card. That said, you may need to keep making payments on your existing balances. Most balance transfer credit cards require you to pay a balance transfer fee of 3% to 5% of the transfer amount. For example, a $10, balance onto a card with.