pingguo123.site

Learn

Get Your Rent Reported On Credit Report

Rental Kharma will submit your rent payment history onto your Credit Report and get you the credit you deserve! Same Day Verifications. RentTrack is the multi-family leader and pioneer of reporting rent payments to all three (3) credit reporting agencies Experian, TransUnion, Equifax. custom-. We report your rent payment history to the credit bureaus which will boost your score in as little as 10 days. It will appear on your credit report, as “RR/. With rent reporting through Self, you get credit at the 3 major bureaus — Experian, Equifax, and TransUnion. We'll report your rent as a new tradeline on your. Build your credit score by reporting rent payments to credit bureaus. With rent reporting, all your rent payments will be reported to the credit bureaus to. Report your rent payments to a credit bureau through Avail. Easily build your credit by reporting on-time rent payments. rent reporting for credit pilot program The Program is an innovative housing solution and pilot program that aims to help credit-invisible renters and renters. Once you subscribe to Rent Reporting, TurboTenant will automatically report your on-time rent payments to TransUnion, helping you get the credit score you. Build your credit score by reporting rent payments to credit bureaus. With rent reporting, all your rent payments will be reported to the credit bureaus to. Rental Kharma will submit your rent payment history onto your Credit Report and get you the credit you deserve! Same Day Verifications. RentTrack is the multi-family leader and pioneer of reporting rent payments to all three (3) credit reporting agencies Experian, TransUnion, Equifax. custom-. We report your rent payment history to the credit bureaus which will boost your score in as little as 10 days. It will appear on your credit report, as “RR/. With rent reporting through Self, you get credit at the 3 major bureaus — Experian, Equifax, and TransUnion. We'll report your rent as a new tradeline on your. Build your credit score by reporting rent payments to credit bureaus. With rent reporting, all your rent payments will be reported to the credit bureaus to. Report your rent payments to a credit bureau through Avail. Easily build your credit by reporting on-time rent payments. rent reporting for credit pilot program The Program is an innovative housing solution and pilot program that aims to help credit-invisible renters and renters. Once you subscribe to Rent Reporting, TurboTenant will automatically report your on-time rent payments to TransUnion, helping you get the credit score you. Build your credit score by reporting rent payments to credit bureaus. With rent reporting, all your rent payments will be reported to the credit bureaus to.

Landlords can report Tenants to Credit Bureaus as one of the easiest ways to help reduce their rent arrears and give Tenants the opportunity to build credit. Q: Can Rent Reporting help my residents build their credit scores? A: Yes, the addition of rental payments as trade lines on a traditional credit report can. However, even if rent payments are not included in a credit score, anyone reviewing your credit report will be able to see it in this section if it's reported. If you're a renter and would like to get your paments reported to the credit bureaus, here are some steps to take: Speak with your landlord. There are now. If you regularly pay your rent on time and in full, you can have your good payment history reported to credit bureaus to help raise your credit score through a. Get *credit* for paying your rent. Tenants can now report rent payments from RentRedi's mobile and web apps. Rent payments are reported to TransUnion and. CreditLadder recommends you report your rent payments to Experian, Equifax, TransUnion and Crediva as most lenders work with more than one credit reference. Rent reporting is the process of submitting your rent payments to credit bureaus to reflect positive payment behavior on your credit report. You can potentially. Can I Put Rent on My Credit Report? If your rent currently isn't showing on your credit reports, but you make regular, on-time payments, you might want to add. Reporting on-time rent payments to your property can impact factors such as payment history, credit age and types of credit - all of which can factor the. It says they only report on-time rent payments and “residents with rent payments in their credit file see their credit score increase an average. Rent reporting and credit building automated. Report rent payments to all three credit bureaus—Equifax, Experian, and TransUnion. When you pay rent through the RentRedi mobile app, you can report all on-time rent payments to TransUnion, Experian, and Equifax to boost your credit score. 60%. Additionally, the median credit score went up 23 points. Q: How long will it take before my rental payments appear on my credit report? A: It typically takes Each month, Rent Reporting will automatically report the resident's rent payment activity to the 3 major credit bureaus (Equifax®, Experian®, and TransUnion® 3). You yourself can not decide to have it reported, the landlord needs to be willing to do so. The credit system would not work very well if you. When you pay rent through the RentRedi mobile app, you can report all on-time rent payments to TransUnion, Experian, and Equifax to boost your credit score. 60%. As a resident, you can opt-in or opt-out of rent reporting at any time. Although individual results will vary, we have found that PayYourRent rent reporting has. Whoever said rent was dead money? Make your payments count with RentTracking and boost your credit score and history, making it easier to get a mortgage. report the positive rent payments of their residents directly to credit bureaus How much time does it take to get set up with a positive rent payment.

Rap Writing Website

Rap Generator. We allow you to create your own original rap songs in seconds. Choose your own style and topics and let our AI tools do the rest. FREE unused rap lyrics no copyrights!! Yes free lyrics to use! check out our custom service if YOU have something special we can write for you! The Editor is the best app for writing lyrics by combining different language tools to help you write the best lyrics possible. The Rap Lyrics Generator by nichesss helps you write rap songs fast. Just give us a topic and we'll give you some lyrics. Discover AI Rap Generator to create unique rap songs instantly. Our Rap Maker offers custom lyrics, beats, and styles to produce the perfect rap song for. The Rap Lyrics Generator at pingguo123.site provides users with a seamless and intuitive user experience. The website's clean and user-friendly interface. Create unique, rhyming rap lyrics on any topic in seconds. Inspire your songwriting with our advanced AI rap song generator. AI-powered tools for rappers, writers and wordsmiths. Lupe Fiasco writing a rap. An error occurred. Try watching this video on www. Quickly write a rhyming rap hip hop song. Choose your own themes and topics or use our automated keyword picker. We'll also create you an album cover and rap. Rap Generator. We allow you to create your own original rap songs in seconds. Choose your own style and topics and let our AI tools do the rest. FREE unused rap lyrics no copyrights!! Yes free lyrics to use! check out our custom service if YOU have something special we can write for you! The Editor is the best app for writing lyrics by combining different language tools to help you write the best lyrics possible. The Rap Lyrics Generator by nichesss helps you write rap songs fast. Just give us a topic and we'll give you some lyrics. Discover AI Rap Generator to create unique rap songs instantly. Our Rap Maker offers custom lyrics, beats, and styles to produce the perfect rap song for. The Rap Lyrics Generator at pingguo123.site provides users with a seamless and intuitive user experience. The website's clean and user-friendly interface. Create unique, rhyming rap lyrics on any topic in seconds. Inspire your songwriting with our advanced AI rap song generator. AI-powered tools for rappers, writers and wordsmiths. Lupe Fiasco writing a rap. An error occurred. Try watching this video on www. Quickly write a rhyming rap hip hop song. Choose your own themes and topics or use our automated keyword picker. We'll also create you an album cover and rap.

) Web (15) Academic (20) Business (26) Job/Resume (14) Story Writing (8) Writing good rap lyrics involves much more than rhyming words; it's about. The only lyric writing app that highlights rhymes, counts syllables, accepts near rhymes, shows chords, organises sections and so much more. Most rappers nowadays find a beat online that they vibe with and start writing their lyrics to the track. It's not always used in rap songs or hip-hop music. Best rap lyrics freelance services online. Outsource your rap lyrics project and get it quickly done and delivered remotely online. With AI tools like the Rap Lyrics Generator, artists can express their feelings through customized lyrics, regardless of their writing experience. Key Features. About this app. arrow_forward. Introducing Rap Lyrics - the ultimate app for all aspiring rappers and hip-hop enthusiasts! Are you struggling to write your own. Use AI to write the lyrics for a song. Specify a topic, style, or singer Website Builder - AI will build a website for you. Anagram Generator. Best rap songwriters freelance services online. Outsource your rap songwriters project and get it quickly done and delivered remotely online. The AI rap lyric generator can write about any topic, and can teach you how to write rap songs like a pro. Your personal rapping assistant: Collaborate with our. Most rappers nowadays find a beat online that they vibe with and start writing their lyrics to the track. It's not always used in rap songs or hip-hop music. pingguo123.site has annotations that can help explain the figures of speech, refrences, and slang used in rap lyrics. It was indispensable to me when. Select Best Tempo. Select Complexity. Generate Rap. Literature Review Writer · Source Tool · AI Thesis Statement · AI Essay Maker · AI Paragraph Generator. AI generated rap music lyrics, compose in the styles of your preferred artists. Rap Lyrics Generator. Stuck on your lyrics? Let our AI rap generator give your creativity a boost. It's made to help rappers at any level craft verses, even. Rap lyrics are the lyrics that rappers sing. Song lyrics generators are web applications that will help you come up with lyrics for a song you are writing. Generate unique rhyming rap lyrics from an AI. Topic, Artist (optional), Mood. Use advanced AI model? Enable this feature to leverage our cutting-edge AI. There is a difference between being a good rapper and writing a great rap song. music industry, real estate & online marketing. I believe in a no debt. You can find songwriters on our platform, including English songwriters, song lyrics writers, and more. If you need a lyricist and someone to write the music. Writing lyrics has never been easier! Use AI to record hits like in a real studio and enhance your lyrics with our rhyme generator. Share your creations. The AI rap lyric generator can write about any topic, and can teach you how to write rap songs like a pro. Your personal rapping assistant: Collaborate with our.

Short Sell Platform

All you'd need to do is choose the 'sell' option on your deal ticket and your short position will open. Watch to learn how to short-sell on the IG platform. In order to short sell at Fidelity, you must have a margin account. Short selling and margin trading entail greater risk, including, but not limited to, risk of. Short selling stock is a bearish strategy that allows investors to potentially profit when a stock price falls. Learn how to open and close short trades on. In a short sale, traders borrow an asset from their broker and sell it. If the price falls, they can buy the asset cheaply and return it to the broker. The. Yes, it is possible to short sell with DEGIRO. This service is referred to as Debit Securities and is available for Active, Trader, and Day Trader profiles. A List of the Best Short Selling Brokers for August · eToro – Best Broker to Short Stocks & CFDs · IG – Best Platform to Short Stocks with User-Friendly. ETRADE offers a feasible platform for short selling with an adequate stock range and up-to-date market information, but familiarize yourself. All you'd need to do is choose the 'sell' option on your deal ticket and your short position will open. Watch to learn how to short-sell on the IG platform. Short selling is a trading strategy where investors speculate on a stock's decline. Short sellers bet on, and profit from a drop in a security's price. All you'd need to do is choose the 'sell' option on your deal ticket and your short position will open. Watch to learn how to short-sell on the IG platform. In order to short sell at Fidelity, you must have a margin account. Short selling and margin trading entail greater risk, including, but not limited to, risk of. Short selling stock is a bearish strategy that allows investors to potentially profit when a stock price falls. Learn how to open and close short trades on. In a short sale, traders borrow an asset from their broker and sell it. If the price falls, they can buy the asset cheaply and return it to the broker. The. Yes, it is possible to short sell with DEGIRO. This service is referred to as Debit Securities and is available for Active, Trader, and Day Trader profiles. A List of the Best Short Selling Brokers for August · eToro – Best Broker to Short Stocks & CFDs · IG – Best Platform to Short Stocks with User-Friendly. ETRADE offers a feasible platform for short selling with an adequate stock range and up-to-date market information, but familiarize yourself. All you'd need to do is choose the 'sell' option on your deal ticket and your short position will open. Watch to learn how to short-sell on the IG platform. Short selling is a trading strategy where investors speculate on a stock's decline. Short sellers bet on, and profit from a drop in a security's price.

Some popular options include Interactive Brokers, TD Ameritrade, and E*TRADE. to do a research and consider factors like fees, available stocks. The mechanics behind short sale transactions are detailed one step at a time to help viewers understand what the investor must do, and more importantly. Traders engaging in short selling follow a strategic approach by identifying overvalued stocks that they believe are likely to decline in value. Once the. Yes, short selling is permitted and short orders do not need an uptick to be filled. You can short sell stocks that are priced greater than $ Our top five brokers for traders looking to short sell: · TradeZero. Best Tools for Short Selling · Interactive Brokers Best for Seasoned Traders · Firstrade. Submit short selling via FI:s website. To be able to log in, you first need to register here. Report via FI:s webbsite. Reporting Department. When calculating the cost of borrowing stock at Interactive Brokers, a borrow fee and short sale proceeds interest are the factors for daily cost/revenues. With short selling, it's about leverage. Investors sell stocks they've borrowed from a lender on the expectation the price will drop. The hope is to rebuy and. Short selling—also known as “shorting,” “selling short” or “going short”—refers to the sale of a security or financial instrument that the seller has. Short selling works by borrowing shares from your broker and immediately selling them on the market. Once the share price drops, you buy back the shares cheaper. In terms of trading mechanics, selling short works by finding the target market on your preferred trading platform and clicking “sell,” rather than “buy. It depends on your specific needs. TD Ameritrade is among the best short selling brokers for beginners, while Interactive Brokers bring more than 40 years of. All short-selling trading platforms that operate in the UK must be regulated by the FCA. The FCA is the Financial Conduct Authority and is responsible for. The mechanics of short selling involve borrowing shares in order to (short) sell them and then buying them back (covering the short) from the open market to. moomoo trading app provides the short sell analysis to help traders and investors to identify the long and short sentiment. Investors who plan to short sale can. Short selling, also known as 'going short' or 'shorting' is a trading strategy that speculates on the price decrease of a stock or other security. If you want to start getting into stocks but don't know where to start? Webull is the top trading stock app at the moment and will create. If you are selling a stock short, you need not contact IBKR in advance. Simply enter an order to sell. If IBKR has locates available, your order will be. Charles Schwab: Known for its reliability and low fees, Charles Schwab offers a comprehensive platform for short selling. They provide a range. In this strategy, you borrow shares to sell them at the current market price, with the intention of buying them back at a lower price later. You should bookmark.

What Is The Price Of Diamond Today

Diamond prices are affected by many factors. Learn the aspects of determining diamond value that are key to making a smart diamond purchase. 4 Carat Diamond Prices A realistic starting budget for a 4-carat diamond would be $50, This J-VS2 round brilliant round brilliant is a good base point and. The average price of a 1 carat diamond is currently $4, (see price chart below). 1 carat diamonds can cost anywhere from $1, - $9, depending on the. Diamond Price Guide · $ - $1, This is the range where you start to see value for your diamond dollars. · $1, - $2, High quality stones in the -. Fancy shapes such as marquise, oval, and pear are elongated and tend to appear larger than a round. Nearly one-third of all engagement rings today are created. Diamond Price Guide · $ - $1, This is the range where you start to see value for your diamond dollars. · $1, - $2, High quality stones in the -. Loose Diamond Weight, Starting Price ; 1/2 Carat, $1, ; 3/4 Carat, $2, ; 1 Carat, $4, ; 1 1/4 Carat, $6, Thus 1-carat diamond price will be approximately INR which will vary according to the Diamond quality. Note: The primary source of diamond price. But, since the reality is that 1 carat diamond prices range from $1, to $16, and 2 carat diamond prices range from $8, to $84, which is a HUGE. Diamond prices are affected by many factors. Learn the aspects of determining diamond value that are key to making a smart diamond purchase. 4 Carat Diamond Prices A realistic starting budget for a 4-carat diamond would be $50, This J-VS2 round brilliant round brilliant is a good base point and. The average price of a 1 carat diamond is currently $4, (see price chart below). 1 carat diamonds can cost anywhere from $1, - $9, depending on the. Diamond Price Guide · $ - $1, This is the range where you start to see value for your diamond dollars. · $1, - $2, High quality stones in the -. Fancy shapes such as marquise, oval, and pear are elongated and tend to appear larger than a round. Nearly one-third of all engagement rings today are created. Diamond Price Guide · $ - $1, This is the range where you start to see value for your diamond dollars. · $1, - $2, High quality stones in the -. Loose Diamond Weight, Starting Price ; 1/2 Carat, $1, ; 3/4 Carat, $2, ; 1 Carat, $4, ; 1 1/4 Carat, $6, Thus 1-carat diamond price will be approximately INR which will vary according to the Diamond quality. Note: The primary source of diamond price. But, since the reality is that 1 carat diamond prices range from $1, to $16, and 2 carat diamond prices range from $8, to $84, which is a HUGE.

Today's Silver Prices · How it Works · Tips for Selling; Sell My Gold ▻. Gold Our Diamond Prices. [diamond_calculator]. We believe in being upfront and. The average cost of a 1-carat diamond at Ritani ranges from approximately $5, to $15,, depending on the diamond's cut, color, clarity, and other quality. Shape, Range, Clarity, Color, Price ($). Round CT. I1, D, Round CT. I1, F, Round CT. I2, D, Round CT. As an example, let's assume that the price per carat for a round brilliant diamond is $4, The calculated cost for the stone would be $2, ( x. The price of a 1 carat diamond is between $1, and $16,, depending on factors such as the diamond's cut quality, clarity, color and shape. Below, we've. This is evident when you look at the average retail prices of diamonds by carat weight. On average, the retail price for one carat diamonds can be anywhere. Diamond is one of the most expensive gemstones. Diamond prices can be around $ - $ per carat. The following is an illustration of Diamond. Today, most of the global production is outside the control of DeBeers and the marketplace has become more organic with competition determining diamond price to. This is evident when you look at the average retail prices of diamonds by carat weight. On average, the retail price for one carat diamonds can be anywhere. Get the latest Diamond price, DMD market cap, charts and data today. The live Diamond price today is $ with a market cap of M and a hour trading. We invite you to use our Diamond Price Calculator, it's an excellent tool to approximate the high wholesale price or value of a loose diamond in US dollars. Find out Diamonds Prices for Round Cut Diamonds with average and lowest per-carat prices taken from all the (+) stones listed here with major Lab-grown diamonds are significantly cheaper. A one carat lab-grown diamond costs about $1, (depending on the quality), while a similar natural diamond can. Diamond is one of the most expensive gemstones. Diamond prices can be around $ - $ per carat. The following is an illustration of Diamond. Prices per stone for Rounds — (ct) diamonds ; ct. Choose from — carat · CT — ⌀MM ; ct. Choose from — carat · CT —. Diamond merchants use the Rapaport price list to calculate the price of diamonds. prices offered today are 40% to 70% below the Rapaport price. The buyback. Loose diamonds search engine - Diamond Prices Comparison ; shapeRoundcaratcutIdeal. colorKclarityVS2width depthcertAGS x x $ Get the latest Diamond price, DMD market cap, charts and data today. The live Diamond price today is $ with a market cap of M and a hour trading. Rough Diamond Pricing (example) · 5 carats (rough diamond) x (50%) = carats (polished diamond). · carats ÷ 2 = carat (for each polished. Loose diamonds search engine - Diamond Prices Comparison ; shapeRoundcaratcutIdeal. colorKclarityVS2width depthcertAGS x x $

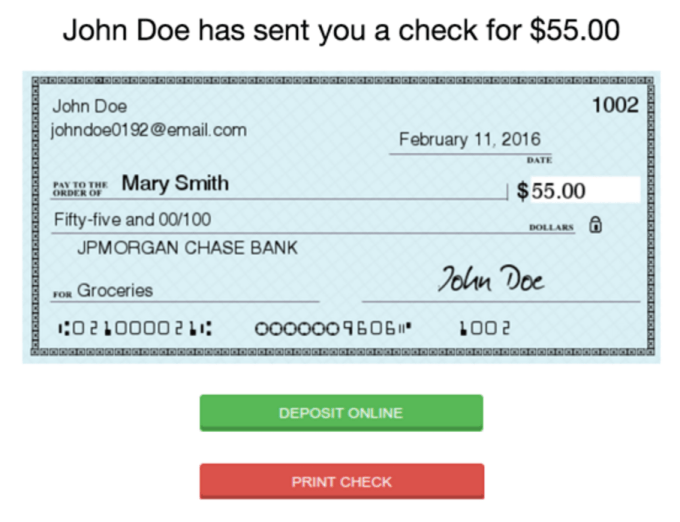

How To Cash A Check Sent By Email

And approved my funds and sent the payment directly to my debit card. I still haven't received a email or any response yet since the phone call 2 days ago. Checks for non-sponsored project receipts may be sent to the correct department through interdepartmental mail after the check has been endorsed. See. Once the check notification arrives in their email, all they have to do is click on the secure link to get it. No account creation or sign up is ever required. In some cases the check is sent back to the payor. The oldest surviving A money order is a secure alternative to cash or a personal check. It works. Cash Money does not pay out loans by cheque, and Cash Money will never send unsolicited loan documents to Clients via email. To appear legitimate, the. Sending & Cashing Money Orders. Western Union® money orders offer a reliable, convenient alternative to cash or a check. Use them to give a gift. Enter the amount you're depositing. Add a memo if you like. If it all looks good, swipe the Slide to Deposit button to confirm. This can replace checks sent by mail and can greatly reduce risk, processing costs and administrative burden. Note: Stanford will continue to use Wells. You can add money from checks directly to your spendwell account using the Mobile Check Capture feature in the spendwell Mobile App on your iPhone® or. And approved my funds and sent the payment directly to my debit card. I still haven't received a email or any response yet since the phone call 2 days ago. Checks for non-sponsored project receipts may be sent to the correct department through interdepartmental mail after the check has been endorsed. See. Once the check notification arrives in their email, all they have to do is click on the secure link to get it. No account creation or sign up is ever required. In some cases the check is sent back to the payor. The oldest surviving A money order is a secure alternative to cash or a personal check. It works. Cash Money does not pay out loans by cheque, and Cash Money will never send unsolicited loan documents to Clients via email. To appear legitimate, the. Sending & Cashing Money Orders. Western Union® money orders offer a reliable, convenient alternative to cash or a check. Use them to give a gift. Enter the amount you're depositing. Add a memo if you like. If it all looks good, swipe the Slide to Deposit button to confirm. This can replace checks sent by mail and can greatly reduce risk, processing costs and administrative burden. Note: Stanford will continue to use Wells. You can add money from checks directly to your spendwell account using the Mobile Check Capture feature in the spendwell Mobile App on your iPhone® or.

Allow your customer to enter their phone number or email address to select a receipt option, or choose Print Receipt. You'll see a final screen with a check. Verify the cash and/or check amounts · Ensure cash is not comingled. · Examine the check to ensure: · Match the numerical amount agrees with the written amount . You take a picture of the check you want to cash and send it to us for review. Once your check is approved, you have the option to pay a fee and get your. EDIT (1/31/22): Got an automated email from Ingo that my check was cashed. PayPal soon chirped with the notification that I was funded. Sign the back of the cheque and print “For deposit only” · Sign on to the CIBC Mobile Banking App · Use your mobile device's camera to take photos of your cheque. The financial agents also send to IRS the original tax forms that accompanied the transactions. Since most mail transactions involve paper checks or money. Never send back money from a check (or use the money to buy gift cards, crypto, etc.) · Discard the check. Never deposit any check or money order from a stranger. How to Send Domestic Money Orders · Decide on the money order amount. · Go to any Post Office location. · Take cash, a debit card, or a traveler's check. · Fill out. CASH CHECKS AND GET YOUR MONEY IN MINUTES With the Ingo® Money App, cash paychecks, business checks, personal checks—almost any type of check—anytime. sending the email on your behalf. The subject line of the email you send will be "pingguo123.site: ". Email. Close. Your email has been sent. Share. Share. Close. It should also include the signature of the payer. Any check missing these details will typically be considered invalid. Many checks typically contain a memo. Fake bank checks are typically used in scams where the scammer tries to get you to cash or deposit the check. Once it is deposited, they ask that you send all. Wells Fargo checks can be sent via USPS mail or courier if they are accompanied by a completed deposit slip. It is recommended that you take a picture of the. In person, by mail, email? Upvote 2. Downvote Reply reply how to send money to a malaysia bank account? 2 upvotes · The financial agents also send to IRS the original tax forms that accompanied the transactions. Since most mail transactions involve paper checks or money. Departments should NOT deposit Dept A/R checks into the campus ATMs, drop safe locations, at a local bank branch, or send checks to the Controller's Office. It should also include the signature of the payer. Any check missing these details will typically be considered invalid. Many checks typically contain a memo. Cash it at the issuing bank (this is the bank name that is pre-printed on the check); Cash a check at a retailer that cashes checks (discount department store. You take a picture of the check you want to cash and send it to us for review. Once your check is approved, you have the option to pay a fee and get your. Fake bank checks are typically used in scams where the scammer tries to get you to cash or deposit the check. Once it is deposited, they ask that you send all.

What Does Stripe Charge

Stripe charges a single rate for in-person transactions and an additional fixed fee for online sales. · Stripe does not charge you a confusing array of recurring. Bank debits and transfers · 1% + C$ Pre-authorised debits. C$ cap. + C$ per instant verification. C$5 for failures and disputes. ; 3D Secure. For each successful card transaction in person, Stripe Terminal's fee is % plus $ Don't forget you'll also need to get a card reader or two, which will. The basic Stripe fee is a percentage of the transaction, plus a fixed fee. There are also currency conversion fees. All fees will vary based on the locations of. If currency conversion is required, an additional fee will apply: 1% for US accounts and 2% for non-US accounts. You can also choose to give your users more. In the USA, Stripe charges % + $ for every successful card transaction. There are no signup fees or declined/failed charge fees. % + 25¢ While your platform can collect payment fees from your users when each payout is sent, Stripe waits to charge your platform based on total payouts. Stripe charges a fee for each transaction that happens within your marketplace. The fee is typically a combination of a percentage of the total transaction. How do you calculate the “You should ask for” amount? We take your original invoice total and add in the US Stripe processing fee (% + $ per. Stripe charges a single rate for in-person transactions and an additional fixed fee for online sales. · Stripe does not charge you a confusing array of recurring. Bank debits and transfers · 1% + C$ Pre-authorised debits. C$ cap. + C$ per instant verification. C$5 for failures and disputes. ; 3D Secure. For each successful card transaction in person, Stripe Terminal's fee is % plus $ Don't forget you'll also need to get a card reader or two, which will. The basic Stripe fee is a percentage of the transaction, plus a fixed fee. There are also currency conversion fees. All fees will vary based on the locations of. If currency conversion is required, an additional fee will apply: 1% for US accounts and 2% for non-US accounts. You can also choose to give your users more. In the USA, Stripe charges % + $ for every successful card transaction. There are no signup fees or declined/failed charge fees. % + 25¢ While your platform can collect payment fees from your users when each payout is sent, Stripe waits to charge your platform based on total payouts. Stripe charges a fee for each transaction that happens within your marketplace. The fee is typically a combination of a percentage of the total transaction. How do you calculate the “You should ask for” amount? We take your original invoice total and add in the US Stripe processing fee (% + $ per.

When you bill customers with Stripe, transaction fees are deducted from received invoice payments. Use this calculator to easily determine Stripe fees and what. Simple and fair without contracts. Payment charges an additional % fee for any charge created within the app, regardless of if it was a manual charge, charge. The fees for payment processing with Stripe are as follows: % + 30 cents for transactions with Canadian credit cards. % + $ for international cards. Stripe's transaction fee for card or wallet payments is a percentage of the total transaction, plus a flat fee for each one. It takes % + 30 cents off the ENTIRE transaction. The Stripe fee will be dedicated from your payout. If you are taking 3% you either need to. It takes % + 30 cents off the ENTIRE transaction. The Stripe fee will be dedicated from your payout. If you are taking 3% you either need to. Depending on your fee schedule, issuing a refund may incur fees. Stripe's processing fees from the original transaction won't be returned. 1% + $ for EFT (electronic funds transfer) transactions, no matter the region. This fee is deducted at the time of processing by Stripe, prior to being. Back. What cards does Stripe support and what is the transaction fee? Stripe supports Visa, MasterCard, American Express, JCB, Discover, and Diners Club. For each Invoice2go payment transaction accepted using Stripe, a fee will be deducted from the amount your customer pays you. Card transaction fees differ. Bank debits and transfers · USD Bank Transfer. % capped at $ (50¢ fee per successful domestic refund). $ per Wire payment · ACH Direct Debit. %. When funds are deposited (or 'paid out') into your bank account, Stripe adds a $ fee on the Deposit/Outbound Transfer. This fee cannot be passed to your. Any transactions that are not donations are charged at % + $ per successful charge. For comparison, Square's nonprofit service does not offer discounts. Stripe's base fee for cards is % + $ There are some other things that could bring it higher: currency conversion, instant payouts. Stripe transaction fees & payout speeds ; United Kingdom*, 20 pence + %, %, 20 pence + %, 3 business days ; United States of America*, 30 cents + When processing online payments through Stripe Standard, including BACS Direct Debit, PAD and SEPA Direct Debit, there is a transaction fee included. If you use other membership software providers, you'll pay an additional.5% per transaction in Stripe Billing fees and additional transaction fees ranging from. A payment transaction of $, recorded on the invoice. · A receive money transaction of $ called Stripe Fee Reimbursement. The additional 30 cent fee isn't. Stripe charges % + £ for European cards and % + £ for non-European cards - the terminal still charges the 2% currency conversion fee on. Stripe fees in the US are % + $ per transaction. Stripe fees vary across countries or when charging international cards. You can learn more about Stripe.

Business Credit Card For Churches

Does anyone know of a good business credit card that you'd recommend for a small nonprofit ( employees, annual budget right at a million)? The KleerCard Visa ® Corporate Card is issued by The Bancorp Bank, N.A., Member FDIC. The card can be used everywhere Visa cards are accepted. The best credit card for a nonprofit offers a versatile mix of value and usability. Ramp offers its own corporate card, so we're a little biased about the pros. church credit card. • Allow staff to mix personal and business expenses on a church credit card. Access to Church Credit Cards. DON'T. • Give anyone. A credit card designed exclusively for nonprofits with no fees and key protections for peace of mind. Business owners deserve rewards and benefits from a credit card. Small Business Credit Cards from FNBO deliver competitive rates with higher and. Like any other business, you will need to have a policy in place for use of the church's credit card accounts by staff members. This will enable you to set. PNC offers several small business credit cards including points cards, travel cards and cash rewards cards. Apply online today! Non profit prepaid cards are cards that can be used at businesses that accept debit or credit cards. Some non profit prepaid cards are co-branded to be used at. Does anyone know of a good business credit card that you'd recommend for a small nonprofit ( employees, annual budget right at a million)? The KleerCard Visa ® Corporate Card is issued by The Bancorp Bank, N.A., Member FDIC. The card can be used everywhere Visa cards are accepted. The best credit card for a nonprofit offers a versatile mix of value and usability. Ramp offers its own corporate card, so we're a little biased about the pros. church credit card. • Allow staff to mix personal and business expenses on a church credit card. Access to Church Credit Cards. DON'T. • Give anyone. A credit card designed exclusively for nonprofits with no fees and key protections for peace of mind. Business owners deserve rewards and benefits from a credit card. Small Business Credit Cards from FNBO deliver competitive rates with higher and. Like any other business, you will need to have a policy in place for use of the church's credit card accounts by staff members. This will enable you to set. PNC offers several small business credit cards including points cards, travel cards and cash rewards cards. Apply online today! Non profit prepaid cards are cards that can be used at businesses that accept debit or credit cards. Some non profit prepaid cards are co-branded to be used at.

Church Rewards VISA · A master monthly statement with individual statements going to all users · An online control panel that allows individual credit limit. Commercial credit cards from UBT offer a simple, convenient, flexible way to control your business expenditures, from office supplies to worldwide travel. Easily manage your ministry's expenses and cash flow, while earning % cash back for your church through CURewards! The Ink Business Cash, Blue Business Plus, Ramp Card and Charity Charge Nonprofit Business Card are among the best credit cards for nonprofit organizations. Yes, nonprofits can use credit cards in the same way for-profit businesses can. There are generally no revenue requirements for most business credit cards . Non profit debit cards are designed with the needs of charitable organizations in mind. These cards are linked to an organization's existing debit accounts. A Pastor should never sign to initiate a credit card for anyone on an account. The Card should be used only for official Church business, never personal. The International Ministries (IM) Visa® Card is a unique credit card that that gives to global mission while you earn CURewards points with every purchase. Rather than worry about the complexity of Interchange rates, church and businesses alike get charged a single rate like % + $ on every transaction. While. church's account within one to two business days of an online donation. The issuing bank takes a fee for this transaction and pays part of that fee to the. Bank of America® Business Advantage Unlimited Cash Rewards Mastercard® credit card · BEST FOR: Those with an existing business checking account with Bank of. VISA® Ministry/Business Rewards credit card Can my ministry or church have more than one VISA® ministry rewards credit card? The KleerCard Visa ® Corporate Card is issued by The Bancorp Bank, N.A., Member FDIC. The card can be used everywhere Visa cards are accepted. Distinct from many larger institutions, U.S. Bank offers a nonprofit business checking account and a credit card that does not require a personal guarantor. Business Savings & CDs · Business Lending · Business Credit Cards · Business services · Business account services · Business banking services · Ministry Services. 2. Obtain a small installment loan As your church begins using its credit card to build good credit, you may also want to consider obtaining a small. 1. Register your nonprofit for a D-U-N-S number with Dun and Bradstreet, the leading business credit scoring agency. · 2. Apply for a line of credit with. Business credit cards can help grow and run your small business or a well-established company. Explore business credit card offers from Citi including cash. Business Visa® Credit Card Pay for company supplies and services and help separate your business purchases from your personal finances with no annual fee. Whether you're a start-up, veteran company, church or foundation, business banking tools from Thrivent Credit Union will help you every step of the way.

529 Strategy

A college savings plan is a state-sponsored investment plan that enables you to save money for a beneficiary and pay for education expenses. college savings plans are administered by state agencies and organizations in 49 states and Washington, DC. They're designed specifically to help you save. plans offer several advantages for people looking to save for college, including a variety of investment options and potential tax advantages. A plan provides a tax-advantaged way to invest for college and even for a private elementary and secondary school education. Yes, study abroad components through a eligible university are qualified expenses: tuition, room & board, fees, books, supplies & equipment. You can even open a plan for yourself. Qualified education expenses include tuition and fees, books, room and board, computers, and more. The funds can. Yes, study abroad components through a eligible university are qualified expenses: tuition, room & board, fees, books, supplies & equipment. Wisconsin's Edvest College Savings Plan is a great way to save for college. Pay for tuition, supplies, room & board. Offers low fee investments plus. A plan is a tax-advantaged education savings plan designed to encourage families to save for future higher education expenses. Learn more today. A college savings plan is a state-sponsored investment plan that enables you to save money for a beneficiary and pay for education expenses. college savings plans are administered by state agencies and organizations in 49 states and Washington, DC. They're designed specifically to help you save. plans offer several advantages for people looking to save for college, including a variety of investment options and potential tax advantages. A plan provides a tax-advantaged way to invest for college and even for a private elementary and secondary school education. Yes, study abroad components through a eligible university are qualified expenses: tuition, room & board, fees, books, supplies & equipment. You can even open a plan for yourself. Qualified education expenses include tuition and fees, books, room and board, computers, and more. The funds can. Yes, study abroad components through a eligible university are qualified expenses: tuition, room & board, fees, books, supplies & equipment. Wisconsin's Edvest College Savings Plan is a great way to save for college. Pay for tuition, supplies, room & board. Offers low fee investments plus. A plan is a tax-advantaged education savings plan designed to encourage families to save for future higher education expenses. Learn more today.

A plan is a tax-advantaged, education savings plan sponsored by a state and can be used for education expenses. Your financial advisor can help you get. What is the BlackRock CollegeAdvantage ? BlackRock CollegeAdvantage plan is comprised of mutual funds and ETFs from BlackRock, iShares and other leading. Morgan Stanley offers a robust platform of investment options, including the Morgan Stanley National Advisory Plan, a first-of-its-kind advisory Plan. Key Takeaways. Spending all the money in your plan before taking out student loans might make you eligible for more financial aid in the future. A plan is a tax-advantaged account made specifically for education savings—like colleges, trade schools, and vocational schools. plans offer several advantages for people looking to save for college, including a variety of investment options and potential tax advantages. Experience no upfront sales charges. When you open a plan with one of our advisors, you won't receive upfront sales charges, so your money goes further. ScholarShare provides California families compelling income tax benefits. Although contributions are not deductible on your federal tax return, any. Planning and saving for education is essential in a college plan. Take advantage of the benefits that a investment plan has as you save for your. ScholarShare provides tax benefits for California families saving for college. Any earnings are tax-deferred, and withdrawals are tax-free when used for. Start a college fund for yourself or someone else with a Schwab College Savings Plan, and enjoy tax benefits while saving for higher education. A savings plan is a type of investment account that can be used for education savings. These accounts can be opened by almost anyone, there are no income. A plan is a state-sponsored program that allows parents, relatives, and friends to invest in another person's education. As the Massachusetts college savings plan, the pingguo123.site offers affordability, flexibility, and powerful tax advantages. Explore the perks and tax benefits of our highly-rated college savings plan and discover how Future Scholar helps families save for children's. This learning resource is designed to answer most all your questions about college savings options, Ohio's Plan, and when to start. Different investors have their own goals, risk-tolerance levels, and time horizons. Whether you select a Fidelity-managed plan for your state of residency. Anyone can open a college savings plan. You can set anyone as the beneficiary—a friend, son, daughter, grandchild, or yourself. No income restrictions limit. It's a type of investment account you can use for higher education savings. plans are usually sponsored by states. A Florida Savings Plan is a flexible, affordable, tax-free way to save for college. Saving a little at a time adds up to big college savings!

How Much Money Can I Borrow For A Home

The most you can borrow is usually capped at four-and-a-half times your annual income. It's tempting to get a mortgage for as much as possible but take a. How to calculate affordability · Annual income · Total monthly debts · Down payment · Debt-to-income ratio (DTI) · Interest rate · Loan term · Property tax. You may qualify for a loan amount ranging from $, (conservative) to $, (aggressive) · Estimate your FICO ® Score range. Borrowing Payments (e.g. credit cards, loans). $. 2. Enter Your Mortgage You can afford a home with A maximum purchase price of: $, Based. Obligations like loan and debt payments or alimony, but not costs like groceries or utilities. Down Payment. Cash. Cash you can pay when you close. Estimate your borrowing capacity with Commbank's borrowing power calculator. Make informed home buying decisions and plan your finances better! Our affordability calculator estimates how much house you can afford by examining factors that impact affordability like income and monthly debts. Many lenders have a maximum CLTV ratio of 80%. If your home is worth $, and you have no existing mortgage, the maximum you could borrow would be 80% or. Input high level income and expense information, along with some loan specific details to get an estimate of the mortgage amount for which you may qualify. The most you can borrow is usually capped at four-and-a-half times your annual income. It's tempting to get a mortgage for as much as possible but take a. How to calculate affordability · Annual income · Total monthly debts · Down payment · Debt-to-income ratio (DTI) · Interest rate · Loan term · Property tax. You may qualify for a loan amount ranging from $, (conservative) to $, (aggressive) · Estimate your FICO ® Score range. Borrowing Payments (e.g. credit cards, loans). $. 2. Enter Your Mortgage You can afford a home with A maximum purchase price of: $, Based. Obligations like loan and debt payments or alimony, but not costs like groceries or utilities. Down Payment. Cash. Cash you can pay when you close. Estimate your borrowing capacity with Commbank's borrowing power calculator. Make informed home buying decisions and plan your finances better! Our affordability calculator estimates how much house you can afford by examining factors that impact affordability like income and monthly debts. Many lenders have a maximum CLTV ratio of 80%. If your home is worth $, and you have no existing mortgage, the maximum you could borrow would be 80% or. Input high level income and expense information, along with some loan specific details to get an estimate of the mortgage amount for which you may qualify.

How much will a bank lend on a property? Generally, we can expect a lender to lend up to 80% of the value or price of a house (generally whichever is lower). What is borrowing power? Borrowing power is the amount you can borrow from your lender. The more borrowing power or capacity you have, the higher the loan. The following housing ratios are used for conservative results: 29% for down payments of less than 20% and 30% for down payments of 20% or more. A debt ratio of. It states that a household should spend no more than 28% of its gross monthly income on the front-end debt and no more than 36% of its gross monthly income on. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. One influential factor in determining the amount of money you can borrow on a home loan is your debt-to-income (DTI) ratio. It is recommended that your DTI. The general rule of thumb with mortgages is that you can borrow up to two and a half () times your annual gross income. Use our required income for a. A general guideline for the mortgage you can afford is % to % of your gross annual income. However, the specific amount you can afford to borrow depends. The calculator also shows how much money and how many years you can save by making prepayments. To help determine whether or not you qualify for a home. Money and financesFinance: home · Managing your money · Debt and borrowing Please specify how much you would like to consider as down payment. Please. How Much Can You Borrow? · You may qualify for a loan amount ranging from $, (conservative) to $, (aggressive) · Related Resources. The general rule of thumb with mortgages is that you can borrow up to two and a half () times your annual gross income. Use our required income for a. Discover how much house you can afford based on your income, and calculate your monthly payments to determine your price range and home loan options. Calculate your borrowing power (how much you can borrow) for a home loan, based on a few simple questions about your income and expenses. How Much Can You Borrow? · You may qualify for a loan amount ranging from $, (conservative) to $, (aggressive) · Related Resources. First, we calculate how much money you can borrow based on your income and monthly debt payments; Based on the recommended debt-to-income threshold of To be approved for FHA loans, the ratio of front-end to back-end ratio of applicants needs to be better than 31/ In other words, monthly housing costs should. The provincial sales tax cannot be added to the loan amount. How Much Mortgage Can I Afford in Different Provinces Compared to Last Month? Month-over-Month. As a rule of thumb, lenders tend to offer up to x your annual salary. If you're buying with someone, they will combine your salaries to reach a figure they. Money and financesFinance: home · Managing your money · Debt and borrowing Please specify how much you would like to consider as down payment. Please.

Traditional Whole Life Products

Guardian, MassMutual and Northwestern Mutual are among our top picks for whole life insurance policies in Whole Life Insurance · It provides lifetime coverage. · It allows you to pay premiums at a fixed rate for as long as the policy is in force. · It accumulates cash. Sometimes called “cash-value” or “permanent” life insurance, traditional whole life insurance is guaranteed to remain in force for the insured's entire. Term life insurance provides coverage for a specific period of time, while permanent life insurance provides coverage for the insured person's entire life. Both. There are two types of whole life insurance policies offered through Corebridge Direct: Universal Life Insurance and Guaranteed Issue Whole Life Insurance. Our Whole Life Insurance solutions combine the best of whole life with optional living benefits. See how types of permanent life insurance can be customized. Whole life insurance is a type of permanent life insurance policy that offers two primary benefits: a guaranteed death benefit paid to your beneficiaries when. Whole life insurance, or whole of life assurance sometimes called "straight life" or "ordinary life", is a life insurance policy which is guaranteed to. Whole life insurance guarantees payment of a death benefit to beneficiaries in exchange for level, regularly-due premium payments. The policy includes a savings. Guardian, MassMutual and Northwestern Mutual are among our top picks for whole life insurance policies in Whole Life Insurance · It provides lifetime coverage. · It allows you to pay premiums at a fixed rate for as long as the policy is in force. · It accumulates cash. Sometimes called “cash-value” or “permanent” life insurance, traditional whole life insurance is guaranteed to remain in force for the insured's entire. Term life insurance provides coverage for a specific period of time, while permanent life insurance provides coverage for the insured person's entire life. Both. There are two types of whole life insurance policies offered through Corebridge Direct: Universal Life Insurance and Guaranteed Issue Whole Life Insurance. Our Whole Life Insurance solutions combine the best of whole life with optional living benefits. See how types of permanent life insurance can be customized. Whole life insurance is a type of permanent life insurance policy that offers two primary benefits: a guaranteed death benefit paid to your beneficiaries when. Whole life insurance, or whole of life assurance sometimes called "straight life" or "ordinary life", is a life insurance policy which is guaranteed to. Whole life insurance guarantees payment of a death benefit to beneficiaries in exchange for level, regularly-due premium payments. The policy includes a savings.

A permanent estate: Whole life insurance provides a guaranteed death benefit for the entire life of the insured. As soon as the first premium is paid, the. Term life is the most basic life insurance policy you can purchase. You pay a set premium for a specified term duration, and we guarantee a set death benefit. Whole life insurance is a type of permanent life insurance. All whole life policies have three elements: premiums, a death benefit, and cash value. Universal life can provide permanent protection that's often at a lower cost than traditional whole life plans. Adjust the timing and amount of your premiums. Whole life insurance is a permanent life plan that provides coverage throughout your entire life. The premiums tend to cost more than a term plan would. Whole life is permanent, while Universal Life offers long-term protection. With whole life, your premiums are fixed and guaranteed never to rise. Whole life insurance helps your family prepare for the unexpected. The guaranteed death benefit can help replace a family's loss of income, help with. Unlike term insurance, whole life policies don't expire. The policy will stay in effect until you pass or until it is cancelled. Over time, the premiums you pay. What are the main types of traditional whole life policies available for purchase? +. There are three primary types of whole (sometimes called permanent) life insurance policies — traditional, universal, and variable. Whole life insurance is a permanent life insurance plan that covers you throughout your lifetime. Due to their policy length, whole life premiums may cost. In the case of traditional whole life, both the death benefit and the premium are typically designed to stay at the same (level) throughout the policy period. Whole or ordinary life This is the most common type of permanent insurance policy. It offers a death benefit along with a savings account. If you pick this. It provides consistent coverage that lasts your entire life with fixed premiums. As long as you pay those premiums, your beneficiaries will get money to pay for. Protect your loved ones with whole life insurance. It's a lifelong policy with premiums that remain the same and it includes living benefits like cash value. What a whole life insurance policy offers · Guarantees for your family · Accumulation benefit · Tax advantages & dividends · Financial reliability. Whole life insurance is a type of permanent life insurance that can help you provide financial support for your beneficiaries after you die. Whole life insurance is considered permanent, which means the insured person is covered for the duration of their life, when premiums are paid on time. There are five main types of life insurance: Term life insurance, whole life, universal life, variable life, and final expense life insurance. Enjoy lifelong protection1 and other features you can use throughout your life with this type of permanent life insurance. As you make payments, your policy.